Find Out 34+ Truths About Residual Dividend Policy People Did not Share You.

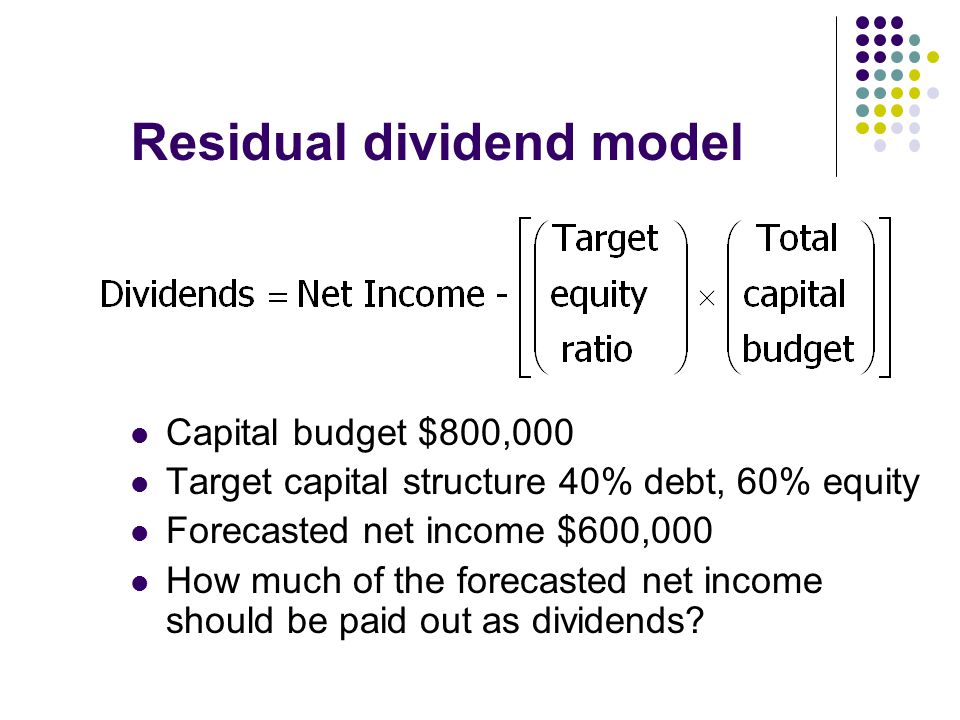

Residual Dividend Policy | • residual theory suggests that dividend policy is irrelevant. Dividends declared are a business liability which needs to be recorded. A residual dividend policy calculates dividends that are based on the amount of equity that remains after capital expenditures associated with the investment have been met. Smith, associate professor of finance. The residual dividend policy approach to dividend policy is based on the theory that a firm's optimal dividend distribution policy is a function of the firm's.

Under the residual dividend policy, dividend payments come from residual equity after expansion investments are satisfied. • too complicated for a first semester course • it is the assets of the firm. A world having significant transactions costs associated with new stock issues b. It's truly the money left over in the business. A residual dividend policy provides greater flexibility to companies compared to other policies, as it puts growth needs and investment before distributions.

This hybrid dividend policy is essentially a blend of the stability and residual policies. A residual dividend policy is basically one type of dividend policy, which states that a company will prioritize capital expenditures before paying out dividends to shareholders. A stable dividend policy c. Dividends are a payment of a share of the profits of a business to shareholders. While there are a number of ways in which a. However, it also means dividends will vary. • residual theory suggests that dividend policy is irrelevant. It's truly the money left over in the business. Essentially, a dividend policy is a cash distribution policy by a company to its shareholders. Chapter 18 dividend policy and retained earnings ppt chapter 18 outline vs. A world having significant transactions costs associated with new stock issues b. Smith, associate professor of finance. The residual model dividend policy is a passive one and, in theory, does not influence market price because the same wealth is created for the investor regardless of the dividend.

The residual dividend policy approach to dividend policy is based on the theory that a firm's optimal dividend distribution policy is a function of the firm's. Chapter 18 dividend policy and retained earnings ppt chapter 18 outline vs. The residual model dividend policy is a passive one and, in theory, does not influence market price because the same wealth is created for the investor regardless of the dividend. Here we discuss the key components of dividend policy and practical examples along with its pros and cost. All spare cash must be either reinvested in the business or redistributed among the shareholders.

Dividends are a payment of a share of the profits of a business to shareholders. A policy of dividend smoothing lintner (1956) 33 had observed that managers tend to value stable dividend policies and corporations tend to smooth. Dividends declared are a business liability which needs to be recorded. Management adopts a residual dividend policy to invest in the company's development, such as upgrading manufacturing capacity or adopting new methods to reduce waste, theoretically resulting in. A residual dividend policy calculates dividends that are based on the amount of equity that remains after capital expenditures associated with the investment have been met. A world having significant transactions costs associated with new stock issues b. The residual model dividend policy is a passive one and, in theory, does not influence market price because the same wealth is created for the investor regardless of the dividend. Dividend policy in practice (with calculations). For this purpose, the company sets its dividend payout for long term period and then. A firm pays 10c constant dividend at. This statistic is a measure of the company's residual dividend policy. This hybrid dividend policy is essentially a blend of the stability and residual policies. • too complicated for a first semester course • it is the assets of the firm.

The argument for dividend irrelevancy assumes that all investment. Here we discuss the key components of dividend policy and practical examples along with its pros and cost. For this purpose, the company sets its dividend payout for long term period and then. This hybrid dividend policy is essentially a blend of the stability and residual policies. A firm pays 10c constant dividend at.

However, it also means dividends will vary. This hybrid dividend policy is essentially a blend of the stability and residual policies. For this purpose, the company sets its dividend payout for long term period and then. Guide to what is dividend policy. The passive residual dividend policy seems to be inconsistent with a. A world having significant transactions costs associated with new stock issues b. A residual dividend model or residual dividend policy is a method that companies use to determine the dividends they will pay out to shareholders. Smith, associate professor of finance. • residual theory suggests that dividend policy is irrelevant. Cash dividend policy types include: While there are a number of ways in which a. • too complicated for a first semester course • it is the assets of the firm. In stable dividend policy, the percentage of dividend of profits to be paid to shareholders is fixed instead of the amount of dividends.

Residual Dividend Policy: A residual dividend policy calculates dividends that are based on the amount of equity that remains after capital expenditures associated with the investment have been met.

Source: Residual Dividend Policy